The US Internal Revenue Service (IRS) issued its much-anticipated guidance on reporting digital asset income in 2019. Since then, it has become mandatory for all taxpayers in the US to address a mandatory digital asset questionnaire on their returns.

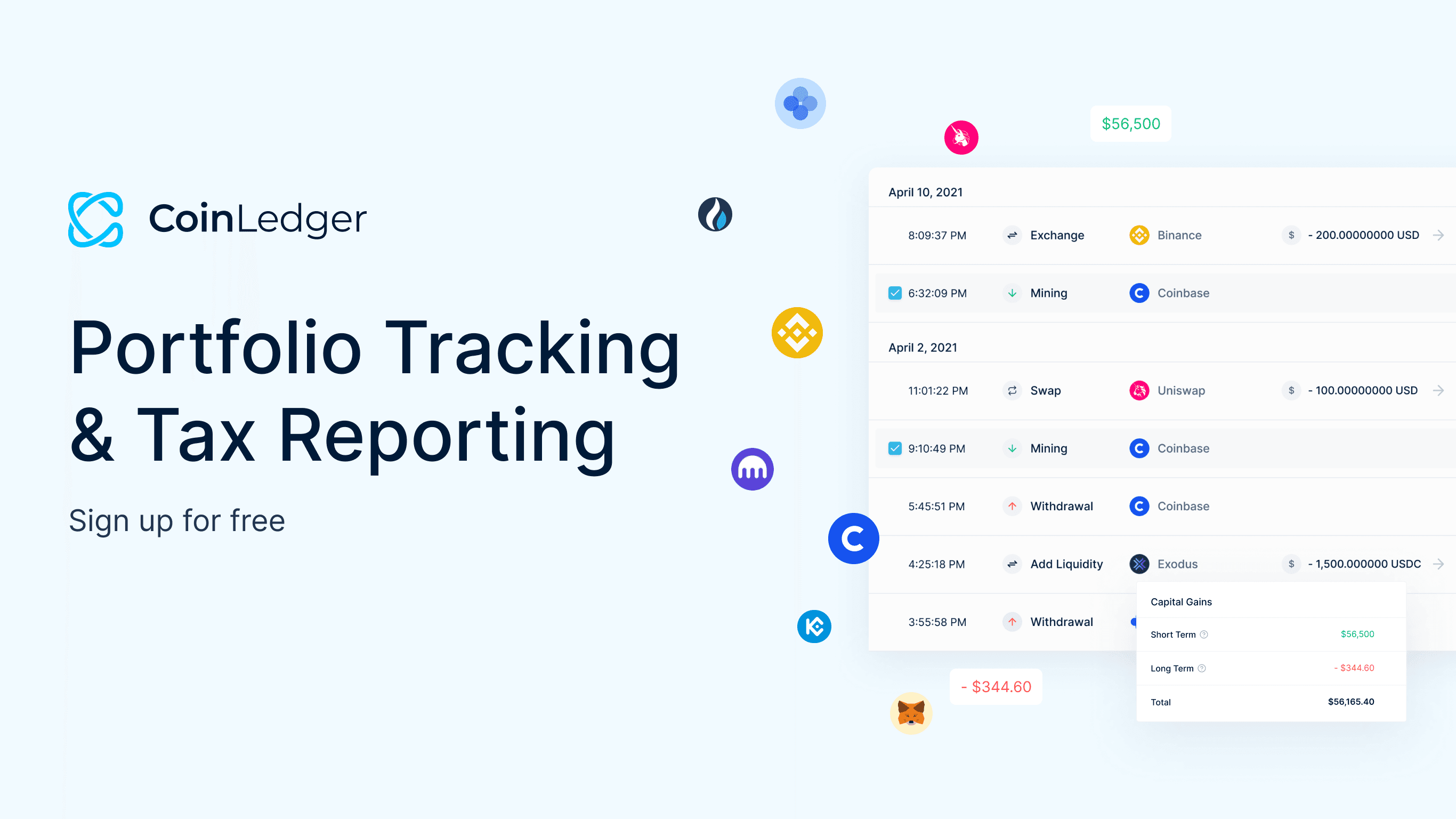

Accurate tracking and managing digital assets is more important than ever for crypto investors and traders in the US and other parts of the world where crypto regulation is catching up. Thankfully, CoinLedger Portfolio Tracker simplifies the complexities of portfolio management, making it easy for anyone to have peace of mind regarding income tax reporting.

At its core, CoinLedger allows its users to track their crypto transactions across multiple wallets and exchanges. It offers a free multi-wallet portfolio tracker with a ‘read-only’ API capable of tracking all your crypto holdings across various wallets.

From automated tracking to CoinLedger’s support for over 10,000 cryptocurrencies, CoinLedger offers exceptional value for crypto investors, making it one of the most popular portfolio trackers in the sector.

Here is a detailed review of what you should expect with CoinLedger.

CoinLedger Overview

CoinLedger was founded in 2018 by David Kemmerer, Lucal Wyland, and Mitchel Cookson after their frustration with automated trading systems that capitalized on price arbitrage across multiple exchanges.

As complex as tracking the volatile prices of cryptocurrencies across multiple exchanges can be, the trio discovered at the time that crypto transaction reporting was even harder.

CoinLedger was, therefore, founded to help the average crypto investor solve the problem of crypto tax reporting. While the platform is not available on mobile app stores, it features a desktop interface and offers a suite of products designed to simplify crypto tax reporting for crypto investors.

What Types of Tax Reports Can CoinLedger Generate?

CoinLedger can generate various types of tax reports, such as:

International Tax Report: With support from the US, Canada, Australia, and 14 other countries, CoinLedger can generate customized tax reports based on different jurisdictions and their regulatory requirements. Users can make any of these reports by simply picking their country and tax year.

Capital Gains Report: This type of report indicates how much an investor has gained or lost while trading crypto to crypto or fiat money. CoinLedger users can use this report to see how much tax they must pay on all their crypto trades.

IRS Form 8949: This report shows an investor’s long-term and short-term capital gains. Since CoinLedger can automatically track your crypto holdings across multiple wallets, you can use the platform to complete this form.

Unlocking Tax Savings With CoinLedger

Apart from helping you accurately report crypto income tax with full automation, CoinLedger also helps with tax loss harvesting through its sophisticated features and intuitive interface.

With CoinLedger, users can easily identify assets that have experienced losses and strategically sell them to offset taxable gains, thereby maximizing tax savings. The platform provides detailed insights into portfolio performance, allowing users to decide which assets to sell and when.

Additionally, CoinLedger offers customizable tax reporting options, including various accounting methods such as FIFO, LIFO, or HIFO, ensuring users can effectively manage their tax liabilities.

CoinLedger’s Affordable Pricing

When it comes to price, CoinLedger is one of the most affordable portfolio trackers. You get a free account to set up your portfolio tracker, which allows unlimited transactions and microtransactions across over 20,000 cryptocurrencies.

You can also use this free version to track NFTs, receive small payouts to your wallet, and edit your reports with no limits. You are only required to pay once you download or import your reports.

All reports are bought one-time for tax reasons. For example, if you need to report on 100 transactions, you will pay $49 for that tax season. Their premium package offers reports across more than 3,000 transactions at $199.

CoinLedger’s Data Security

Given the sensitive nature of financial data, CoinLedger offers a secure data-importing API that is compatible with different exchanges, blockchains, and wallets.

Before importing your transactional data to CoinLedger, you will need to create a read-only API key that is used to synchronize your wallet’s transactional data to your CoinLedger account. This API’s read-only design means your wallet’s private key remains protected as the API is only authorized to access and retrieve data, not to modify or execute transactions.

Furthermore, CoinLedger’s API key is built with security in mind, employing industry-standard encryption protocols to safeguard your data during transmission. This ensures that your sensitive financial information remains confidential and protected from unauthorized access. With its priority on security, CoinLedger provides users with peace of mind, knowing that their assets and personal information are well-protected.

Using CoinLedger With a Tax Professional

For crypto enthusiasts with a small portfolio, using the free version of CoinLEdger can be enough to complete the crypto tax reporting process; however, for investors with larger portfolios, more help is better.

CoinLedger makes it easy for crypto investors to work with an accountant through its “Invite Your Tax Professional” feature that lets you share your crypto tax report with a tax professional.

By inviting your accountant to your reports, you can have your reports reviewed from a unified client dashboard. This feature also prevents you from sending sensitive information over email.

Empowering Your Tax Strategy with CoinLedger

CoinLedger has emerged as one of the most popular crypto portfolio trackers in the crypto space for many reasons. Even though using its desktop dashboard may require a slight learning curve, most users report that its user interface is mostly intuitive with time.

Its free account offers a ton of value, ranging from easy access to automated portfolio tracking to easy generation of multiple reports. For sophisticated investors, CoinLedger makes it easy to work with tax professionals, and there is even an “Error Reconciliation” feature that lets you identify common report errors in your tax reporting.

While some users complain about the platform’s limited crypto wallet support, CoinLedge is constantly working to add more wallets to its list of supported ones.